Coffee Shop & Restaurant Financing, How IBC + Credit Key Can Help

If you own or operate a café, coffee shop, boba shop, teahouse, restaurant, food truck or catering business, you already know that great espresso, friendly service and a cool vibe aren’t enough to guarantee success. Behind every smooth pour is a cash flow story — and without the right funding strategy, even the best cafés can stall. In this post we’ll walk you through the current state of café and coffee shop finances, why managing cash flow is more critical than ever, how Credit Key financing (now available through Innovative Beverage Concepts, Inc. or IBC) works, and why it’s a smart choice for café operators.

1. The Financial Landscape for Coffee Shops

A booming market — but with tight margins

According to one industry report, the U.S. coffee shop industry generates around $70 billion in sales annually, with small coffee shop owners earning between $60,000–$160,000 per year at profit margins of roughly 15–25%. Another benchmark study shows that from 2020–2024, the median revenue of cafés sold was approximately $344,000, with owner’s discretionary earnings around $75,000, or about 21.8% of revenue.

Cash flow is the challenge

Many cafés struggle not because they can’t sell coffee, but because they mismanage cash flow. A recent article points out that café owners need to track cash flow, identify their break-even point, and regularly optimize costs to maintain a healthy profit margin. The biggest mistakes new café owners make are around variable costs, timing of payables and receivables, and unexpected equipment or repair needs.

Costs are significant and fickle

Monthly operating expenses for a café can range between $13,000 and $65,000, depending on size and location. Fixed and variable cost components such as rent, utilities, labor, cost of goods, and marketing mean café owners have to be both nimble and prepared.

Bottom line: While the café business is full of opportunities, the financial reality is more delicate than most expect. For sustained success, you need steady cash flow, cost control, and access to financing when things don’t go exactly to plan.

2. Why Cash Flow Management Matters More Now

Competition from both national chains and local cafés keeps pressure on margins. Supply-chain disruptions, inflation in ingredients, rising rents, and wage pressures all make profit margins tighter. Your café may do well in peak season, but you must plan for slower months, equipment downtime, or unexpected expenses. Having strong cash flow means you can continue to invest in your business even when revenue dips. Traditional bank loans are often cumbersome, so flexible financing fills an important gap for café owners ready to expand. Credit card interest rates remain very high.

3. How Credit Key via IBC Supports Café Financing

IBC now offers Credit Key as a financing checkout option for cafés and coffee shops.

What is Credit Key?

Credit Key is a pay-over-time financing solution designed for business purchases. Think of it as buy-now-pay-later with extended terms for business. Café and foodservice operators can purchase equipment, supplies, or other essentials without paying everything upfront, preserving cash flow.

Key features include:

- Up to $50,000 in credit

- 0%* interest for the first 30 days

- *For a limited time Credit Key is offering IBC customers 90 days no interest!

- Terms up to 12 months, depending on order size

- Instant decision at checkout with no impact on credit score

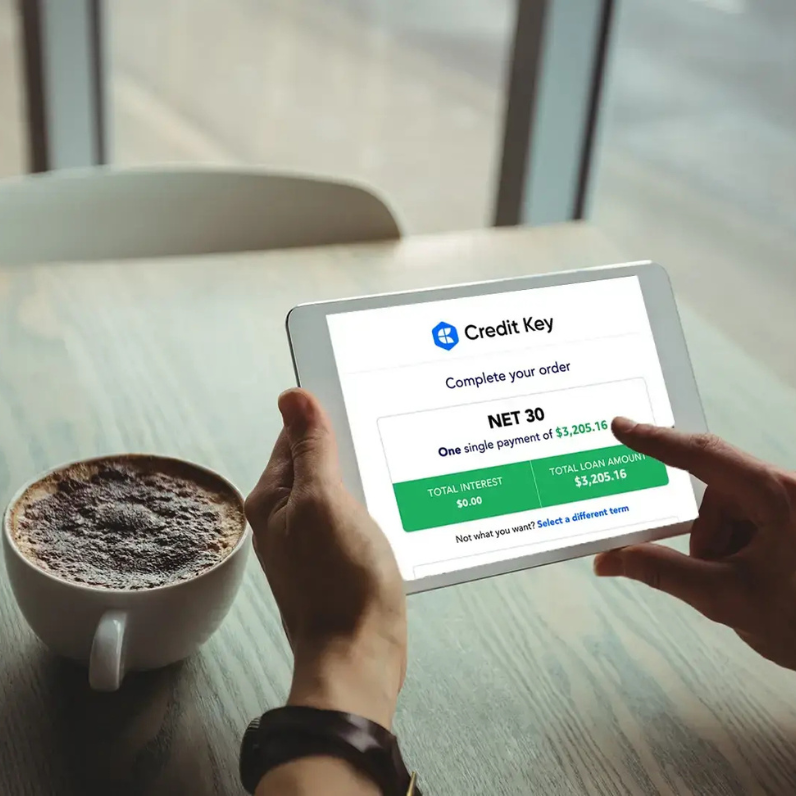

How it works

- Pre-apply here https://www.creditkey.com/app/apply/ibevconcepts or apply at checkout

- Add items to your cart

- At checkout, select the Credit Key payment option

- Log into your pre-approved account or create your Credit Key account and receive an immediate credit decision

- Split your purchase into easy payments

- Finance your order with transparent terms and no early repayment fees

Why this is good for cafés and operators

No money down means you preserve working capital for daily operations instead of tying it up in large purchases. The first 30 days are interest-free (90 days for a limited time), giving you breathing room during seasonal shifts. Flexible terms up to 12 months help you align repayments with your business rhythm, while fast decisioning allows you to act on opportunities right away.

How to apply

At checkout, simply select Credit Key and follow the prompts. You can also pre-apply using this link: https://www.creditkey.com/app/apply/ibevconcepts. Once approved, review your terms, accept, and complete the order.

4. Use-Case Scenarios for Café Operators

- New equipment upgrade: Finance your new espresso machine instead of paying out-of-pocket upfront.

- Menu expansion and remodel: Renovate your space or add new drink equipment while paying over time.

- Seasonal readiness: Stock up on syrups, Mocafe & Teaology powder mixes & ModernOats oatmeal cups, packaging, and supplies for the holidays without straining your budget.

- Cash cushion for emergencies: Handle repairs or downtime without relying on high-interest credit cards.

5. Final Thoughts

Running a café today means managing people, products, and finances all at once. In many cases, the difference between a thriving café and one that struggles is effective cash flow management. With IBC’s new partnership with Credit Key, you can finance growth and preserve liquidity, ensuring your business stays strong through every season.

Next steps

- Review your upcoming needs for equipment or inventory.

- Estimate costs and decide if flexible payments would help.

- At checkout with IBC, select Credit Key to see available terms.

- Use your preserved cash to invest in marketing, new products, or customer experience.

- Get credit up to $50,000

- 0% for 30 Days (90 days for a limited time!)

- As low as 1% after 30 Days

Get a decision in seconds.

Simple, affordable terms: Choose 4 interest-free payments or up to 12 months depending on your order total. Fast, easy financing: First 30 days are always interest-free with no early repayment fees.

FAQs

Q: What is Credit Key?

A: Credit Key is a business financing solution that allows café and restaurant owners to pay over time for purchases made through IBC. It provides up to $50,000 in credit, with 0% interest for the first 30 days (90 days for a limited time) and flexible terms up to 12 months.

Q: Does applying affect my credit score?

A: Checking your rate or applying for approval does not affect your personal credit score.

Q: Who can apply for Credit Key?

A: Credit Key is available to U.S.-based business entities with a valid EIN, and approval is based on your business credit profile and history.

Q: How fast will I know if I’m approved?

A: Most applicants receive a decision in seconds after completing a brief online form at checkout or via the pre-apply link.

Q: Can I use Credit Key for recurring purchases?

A: Yes. Once approved, you can use your Credit Key account for future orders placed with IBC, making reordering fast and convenient.

Q: What are the benefits for café owners?

Preserve cash flow, avoid large upfront costs, reduce reliance on high interest rate credit cards, and match payment schedules with business cycles. Financing through Credit Key gives cafés flexibility to grow without financial strain.

Q: Are there any hidden fees?

A: No. Credit Key provides transparent payment terms, no early repayment penalties, and clear interest rates after the 30-day interest-free period. (90 days for a limited time)

Q: How much can I finance through Credit Key?

A: Eligible businesses can receive up to $50,000 in financing depending on credit approval and order size.

Q: Where do I apply?

A: You can apply directly at checkout when ordering from IBC, or use the pre-application link here: https://www.creditkey.com/app/apply/ibevconcepts

Q: Can I pay off my balance early?

A: Yes. You can pay off your Credit Key balance anytime without additional fees or penalties.

By using Credit Key through IBC, café and coffee shop owners gain access to fast, flexible financing that preserves cash flow, helps manage inventory and equipment needs, and enables smart growth without financial stress.